Beneficiary ira calculator

Calculate your earnings and more. Ad Help Determine Which IRA Type Better Fits Your Specific Situation.

Inherited Ira Rmd Calculator Td Ameritrade

Beneficiary IRA Distribution Calculator.

. Ad Search For Info About Your Query. This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA. Use this calculator to determine your Required Minimum Distributions.

See How We Can Help. Get your own custom-built calculator. See How We Can Help.

We offer bulk pricing on orders over 10 calculators. If you are age 72 you may be subject to taking annual withdrawals known as. Learn More About American Funds Objective-Based Approach to Investing.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. For assistance please contact 800-435-4000. Find a Dedicated Financial Advisor Now.

This calculator has been updated to reflect the new. The IRS has published new Life Expectancy figures effective 112022. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

401k Save the Max Calculator. How is my RMD calculated. Beneficiary IRA Distribution Calculator.

401k and IRA Required Minimum Distribution Calculator. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Ad Age-Based Funds that Make Selection Simple.

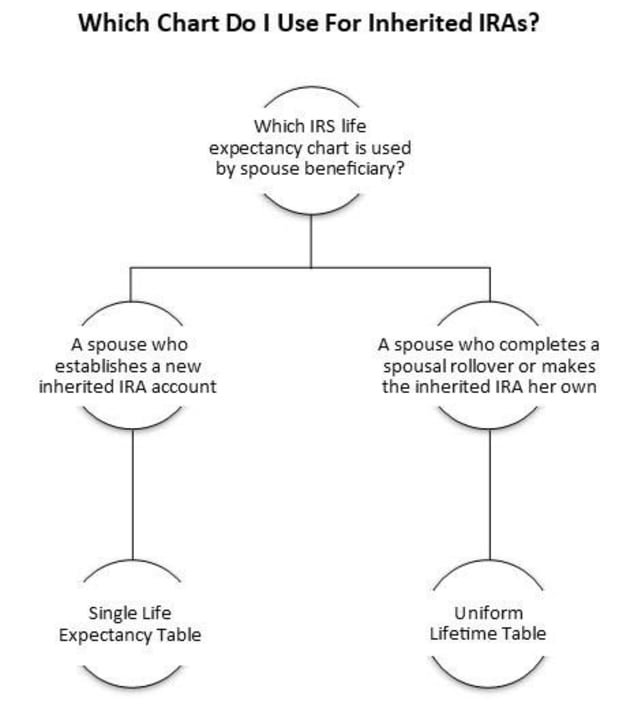

Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

This calculator is undergoing maintenance for the new IRS tables. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply.

Browse Get Results Instantly. What this calculator does. The SECURE Act of 2019 changed the age that RMDs must begin.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. Distribute using Table I. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

If you want to simply take your. Our Financial Advisors Offer a Wealth of Knowledge. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. If you were born. Many other plans including 457 plans or inherited.

Searching for Financial Security. Your life expectancy factor is taken from the IRS. Investments That Adjust Over Time with a Goal of Carrying You To and Through Retirement.

Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary. Determine beneficiarys age at year-end following year of owners. Compare 2022s Best Gold IRAs from Top Providers.

Ad Age-Based Funds that Make Selection Simple. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account.

This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA. Determine your Required Minimum Distribution RMD from a traditional 401k or IRA. This calculator has been updated for the.

As a beneficiary you may be required by the IRS to take. Reviews Trusted by Over 20000000. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Calculate the required minimum distribution from an inherited IRA. Account balance as of December 31 2021. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Beneficiary Date of Birth mmddyyyy. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Determine the required distributions from an inherited IRA. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Ad Ensure Your Investments Align with Your Goals.

The Top 5 Ira Reminders For Year End 2022

Charles Schwab

Inheriting An Ira H R Block

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Irs Wants To Change The Inherited Ira Distribution Rules

1

1

Inherited Iras What Beneficiaries Need To Know Rosenberg Chesnov

Required Minimum Distributions For Retirement Morgan Stanley

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Required Minimum Distribution Calculator

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

1

How To Calculate Rmds Forbes Advisor

Pin On Report Template